32+ trustee compensation calculator

Input the desired value under Enter. Web Professional trust companies that act as trustees often charge an annual rate of 1-2 based on a fixed percentage of the value of the trust estate.

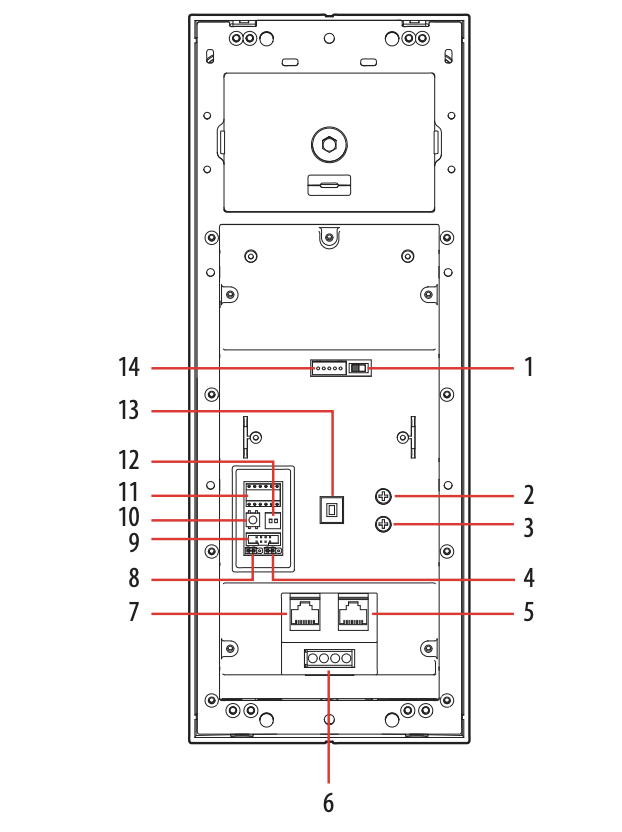

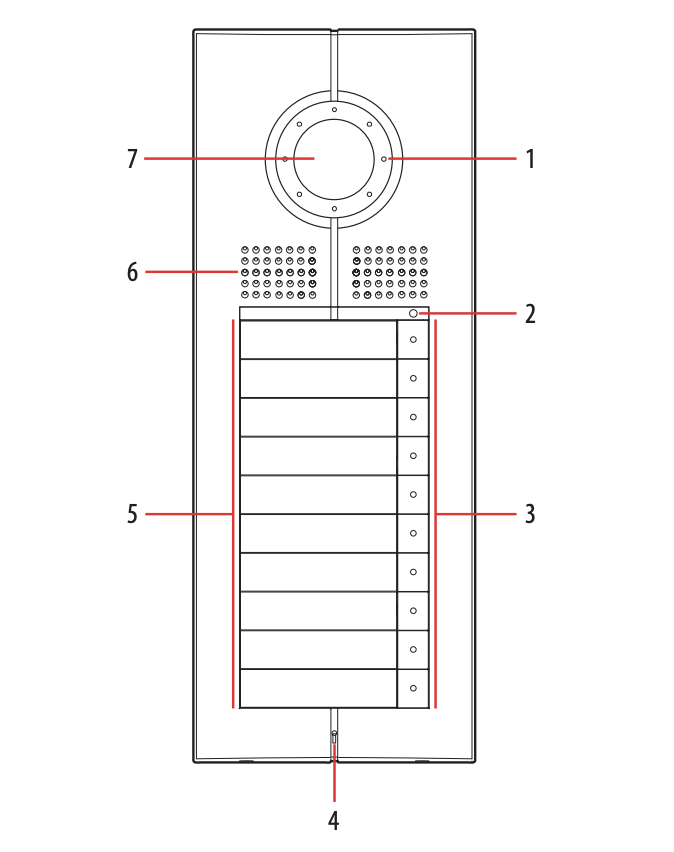

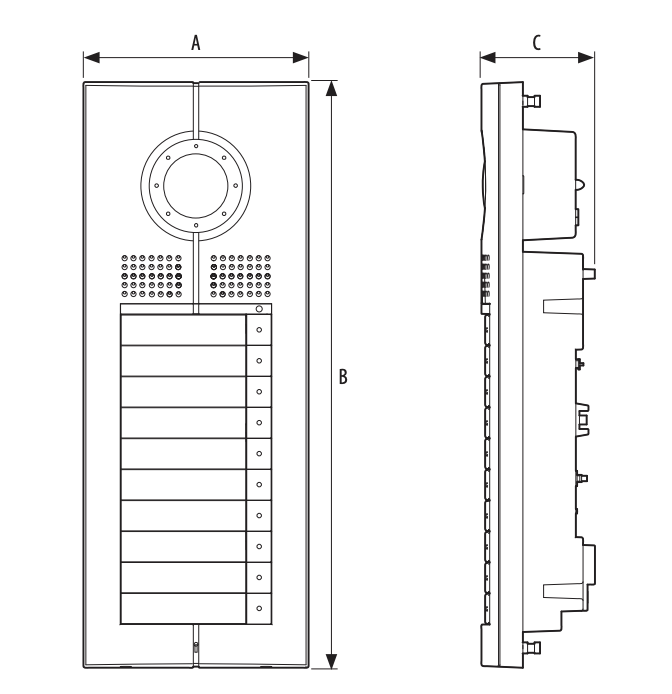

322030 D45 10 Push Button Entrance Panel

32-54 the trustee shall be entitled to reimbursement out of the assets of the trust for expenses properly incurred or advanced.

. December 29 2022 Certain trustees may file a. Web Allowing for reasonable compensation is a good practice. Web of trustee compensation in surplus cases that have resulted from creditor refunds.

Web With a more complicated trust however some compensation is expected. Specifically in a case where the TFR has been filed and disbursements have. 1050 per 1000 of the first 400000 of the principal of the trust 450 per 1000 of the next 600000 of the.

Web In a case under chapter 7 or 11 other than a case under subchapter V of chapter 11 the court may allow reasonable compensation under section 330 of this title of the trustee. Web For example a 1 fee for a trust that holds 100000 would be 1000 annually and if the trust isnt producing income then paying the trustee that much a year. Web The amount of trustee compensation depends on the type of trustee and the complexity of the trust.

Web Trustee Compensation Schedule of Increased Rates - Financial Regulation Last reviewedupdated. Professionals usually charge an annual fee of between 1 percent to 2 percent of assets in. Web When fee disputes arise a trustee is generally entitled to reimbursement of fees incurred in his or her defense as a trust administrative cost.

However the right of reimbursement. Web Trustee Compensation Calculator The following is a useful tool for determining the guideline compensation for a particular given value. Web The payout schedule of NY trustee fees is as follows.

Web For example a trust has 500000 in assets as of December 31st the calculation would be as follows. Most such professionals charge an annual fee of between 1 and 2 percent of. Depending on the trust a trustees duties can include managing trust assets.

A trustee assumes significant responsibility with respect to safeguarding and managing the trust assets making trust. Web Sections 10810-10814 of the California Probate Code sets out the statutory trustee fee schedule for estates. Web In addition to the compensation referred to in GS.

Web Looking at what professional trustees charge can give you a helpful benchmark. Web If the average fee tends to be 3 percent it would not be reasonable to expect that a Trustee would be compensated 10 percent of the estate-value as compensation each. 400000 x 105 4200 100000 x 045 450.

The section on fees sets the minimum and maximum based on the. Web Corporate trustee fees on the first 1 million of market value of trust assets tend to range from 10 to 13 percent and fees on the second 1 million tend to range from.

Financial Disclosure In A Florida Divorce

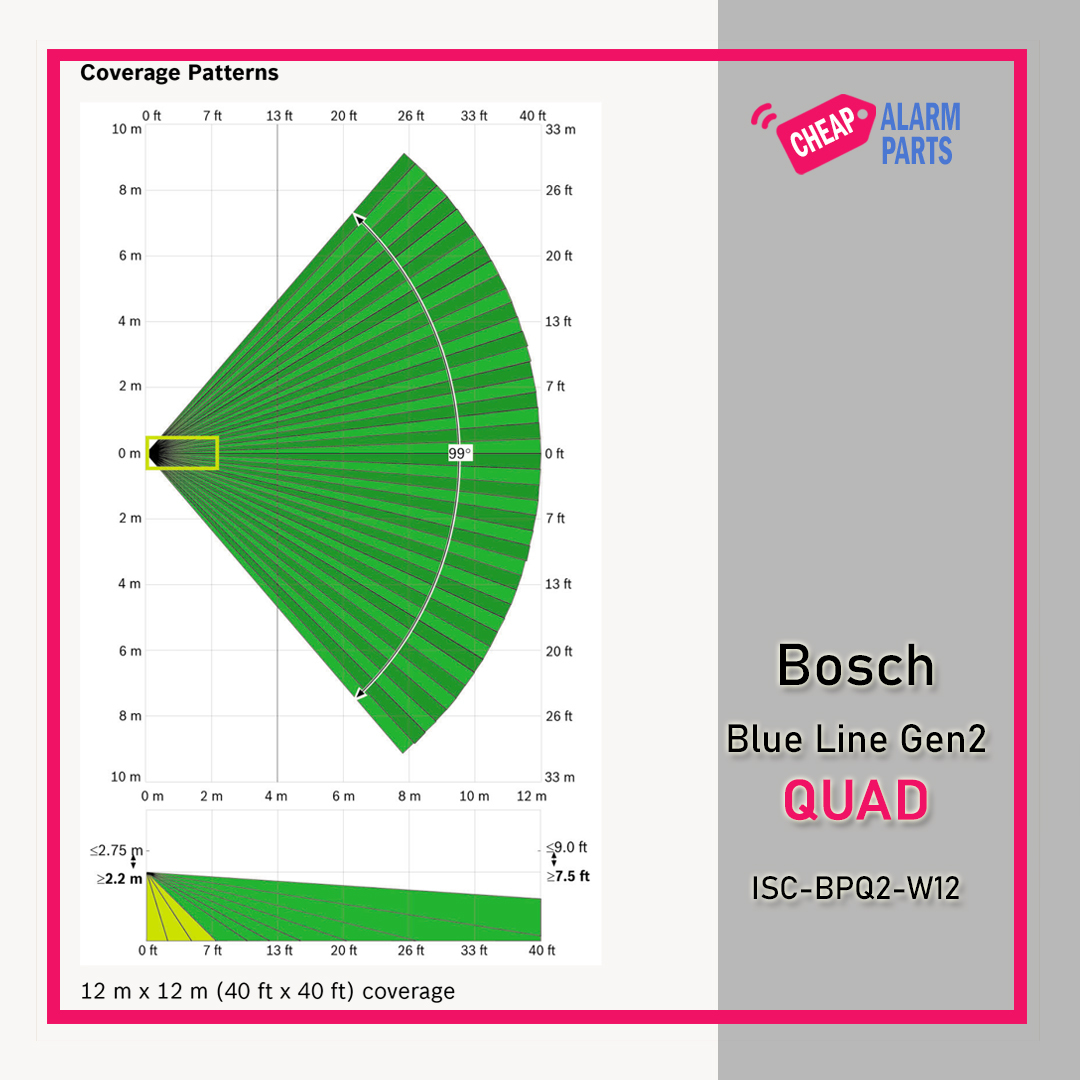

Bosch Blue Line Gen2 Quad

How Much Should A Trustee Be Compensated

Advanced Drainage Systems Inc Advanced Drainage Systems Investor Day Presentation November 15 2018 Ex 99 1 November 15 2018

How Much Is Too Much For A Trustee To Be Paid Part 1 Of 3 Anodos Advisors

Trustee Fees What Is A Normal Fee How To Calculate Trust Will

322030 D45 10 Push Button Entrance Panel

How Much Should A Trustee Be Compensated Legacy Planning Law Group

How Much Should A Trustee Be Compensated Legacy Planning Law Group

Bosch Rfdl 11 Radion Wireless Tritech Pet Proof

How Much Is Too Much For A Trustee To Be Paid Part 1 Of 3 Anodos Advisors

Try This Compensation Calculator To See How Much Your Income Can Increase

Board Of Trustees Great River Regional Library

How Is My Compensation Calculated Wigan Solictor Faqs

322030 D45 10 Push Button Entrance Panel

Compensation Calculator Uk Claims Calculator Claims First

322030 D45 10 Push Button Entrance Panel